Mobile Deposit on the Eglin FCU Mobile App allows you to make a deposit anytime no matter where you are. All you need is a mobile device and a connection to the internet. All transactions made from within our Mobile App are encrypted and secure. The Eglin FCU Mobile App requires Online Banking, if you do not have Online Banking, you may apply now at eglinfcu.org/forms. To learn more about the Eglin FCU Mobile App, or to download, visit eglinfcu.org/mobileapp.

Several Eglin FCU ATMs accept both cash and check deposits and make depositing multiple checks particularly convenient. We have more than 40 ATMs in and around Okaloosa County as well as numerous surcharge-free ATMs in our network. To view the list of Eglin FCU ATMs that accept deposits, visit eglinfcu.org/locations/efcuATMs. To locate a surcharge-free ATM near you, visit eglinfcu.org/locations.

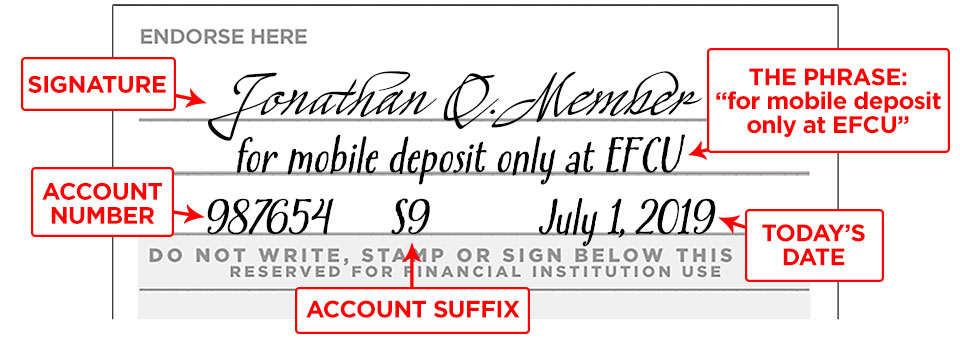

It is important that all deposited checks have been properly completed on the front and signed on the back. Mobile Deposits also require that you include the phrase "for mobile deposit only at Eglin FCU," the current date, your account number and the suffix you are depositing the funds into (Savings: S1, Checking: S9, and Money Market: S7).

What is Mobile Deposit?

Mobile Deposit is a secure, online service that allows you to deposit checks using the Eglin Mobile Application. It is a convenient way for you to make check deposits 24/7 without having to visit a branch or ATM.

Am I eligible for Mobile Deposit?

All members in good standing are eligible for this service provided there are no locks prohibiting transactions on your account.

How do I access Mobile Deposit?

You must install the Eglin Mobile App on your mobile device. To access this service you will need to be enrolled in Online Banking and have a Online Banking PIN.

What are the hardware and software requirements for Mobile Deposit?

Mobile Deposit is currently available on iOS 6.0 and above (iPod Touch 4th generation, iPhone® 3GS and above, iPad 2 and above) and Android devices supporting OS 4.0 and above.

What are the Terms and Conditions for Mobile Deposit?

Please see Eglin Federal Credit Union's Mobile Deposit Disclosure and Agreement.

Can I deposit any check with Mobile Deposit?

You can only use Mobile Deposit for eligible domestic checks not drawn on your own account. Checks must be made payable to the owner of the account and must have the proper endorsement on the back. Checks will not be accepted if they are incomplete, post-dated or stale-dated, made payable to a third party, or stamped with a "non-negotiable" watermark. Be sure your check is legible and has no evidence of alteration or restrictive endorsement. Refer to above Disclosure and Agreement for a complete list of "Unacceptable Deposits".

Should I endorse the back of the check?

Yes. If you do not endorse the back of the check, your Mobile Deposit will be rejected. Your endorsement must include:

If the back of the check is not properly endorsed, we reserve the right to reject the check for deposit. See example endorsement below.

How will I know that a mobile deposit was accepted?

You will receive an immediate on-screen notification that the deposit was either accepted or held for review.

If my deposit was accepted, but is being reviewed, can I try to deposit it again?

No. Once the app has successfully accepted your check it is placed for review. Attempting to resubmit the check will only result in a delay and may cause additional issues, including your deposit being recognized as a duplicate. The application landing page for the Deposit Checks button will display a list of checks being held in review.

What should I do if my mobile deposit is rejected?

You may contact Member Services for assistance through our secure email portal at eglinfcu.org/contact or by calling 800.367.6159 or 850.862.0111, Option 4 during our regular business hours Monday through Friday 9 AM to 5 PM CT.

When are Mobile Deposits reviewed by Eglin FCU staff?

Mobile Deposits are reviewed as soon as possible throughout each business day, Monday through Friday (except federal holidays), 8:30 AM to 5:00 PM CT. The exact timing depends on the volume of deposits in the queue. Checks deposited after the close of business, on weekends or holidays will be reviewed the next business day.

When will the funds be available to me?

Generally, the first $225 from the check deposited will be available immediately and any additional funds will not be available until the second business day after the day the deposit is accepted. You may login to Online Banking to view Account Holds on the Account Details page. Seven business day holds will be applied to checks received for deposit into accounts that are less than 30 days old. Funds you deposit may be delayed for a longer period of time if we have reasonable cause to believe the check may be uncollectable. We will notify you if we delay your ability to withdraw funds. Eglin FCU, in its sole discretion, may modify funds availability for Mobile Deposit as it deems relevant.

I received an email stating that my deposit was posted and I see it in my account. Should I destroy the check now?

Although most check images clear the account on which the check is drawn without any problem, we ask that you retain the check in a safe place for 30 days after the deposit has posted. Be sure to mark it as an item you have already deposited so that it is not inadvertently re-deposited by you or someone else in your household.

What if I've made an error or need to speak with someone about my Mobile Deposit?

You may contact Member Services during regular business hours about your Mobile Deposit by contacting us via secure email or calling us at 800.367.6159 or 850.862.0111, Option 4.

Is there a limit on how large of a check I can deposit through mobile check deposit?

The mobile check deposit limit is $10,000 per day. Please view our Mobile Deposit Disclosure & Agreement for additional information.

Routing Number: 263178070

*APR = Annual Percentage Rate.